Lambert Capital

Leading the Way in Property Development Finance and credit fund management

ARE YOU AN

INVESTOR

Are you a

BORROWER

Lambert Capital

Lambert Capital partners with experienced property developers and sophisticated investors to fund quality projects and realise superior risk-adjusted returns.

Lambert Capital focuses on assisting its many long-standing loyal clients, both borrowers and investors, via its proprietary Lambert Capital Property Credit Fund.

Find Out More about Lambert Capital

Lambert Capital’s Services

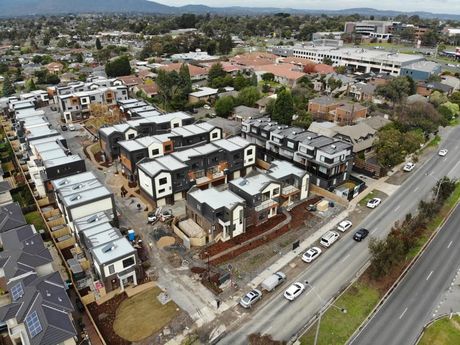

Borrowers

investors

Our Latest Insights